new jersey 529 plan deduction

New Yorks direct-sold 529 college savings plan is available to residents of any state. The ability to switch categories retroactively makes this a flexible option to lock in tuition no matter which particular college the beneficiary attends.

In the Pennsylvania 529 Guaranteed Savings Plan Pennsylvania residents acquire units that increase in value over time to track average tuition increases in one of several school categories as selected by the participant.

. When you are able to purchase items for your business they are paid before you pay income taxes making it a pre tax purchase. New Yorks 529 Program Direct Category. They are named after a section of the IRS code.

Think of your federal and state income tax rates as the amount of savings you get when you can buy something pre tax. Research and compare your states 529 plan college saving options to find the 529 plan that is right for you. It offers low fees and diverse investment options featuring Vanguard mutual funds.

This tab allows you to enter your local county tax rate in New Jersey manually so you can have a more refined tax calculation forecast for your tax return in New Jersey The 529 Plan Contributions allows tax deductions in certain states currently the Tax Form Calculator only applies this tax credit in Indiana please contact us if your. You can learn more about this and any other of the Big 3 by calling the Spiegel Utrera PA General. New York residents may enjoy a state tax deduction for contributions to the plan.

A 529 plan is a type of savings and investment account in which money grows tax-free as long as the withdrawals are for qualified education expenses.

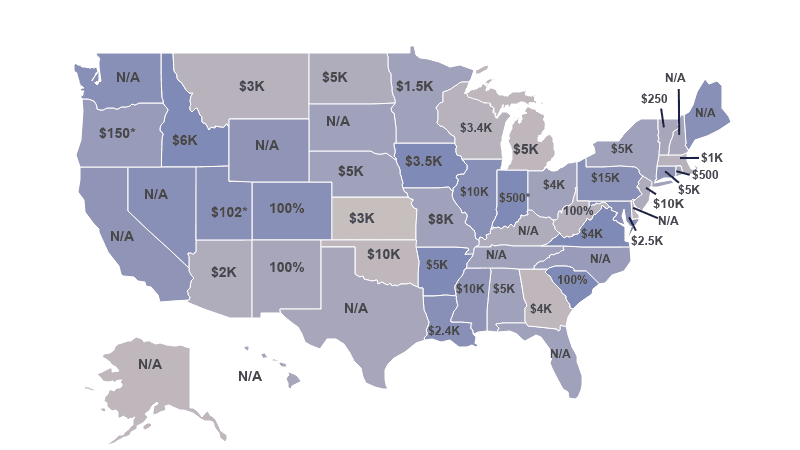

How Much Can You Contribute To A 529 Plan In 2021

Which States Pay The Highest Taxes Family Money Saving Business Tax Economy Infographic

New Jersey 529 Plans Learn The Basics Get 30 Free For College

529 Tax Benefits By State Invesco Invesco Us

529 Tax Benefits By State Invesco Invesco Us

New Jersey Provides Tax Deduction For College Savings Plan Contributions

Vermont 529 Plans Learn The Basics Get 30 Free For College Savings

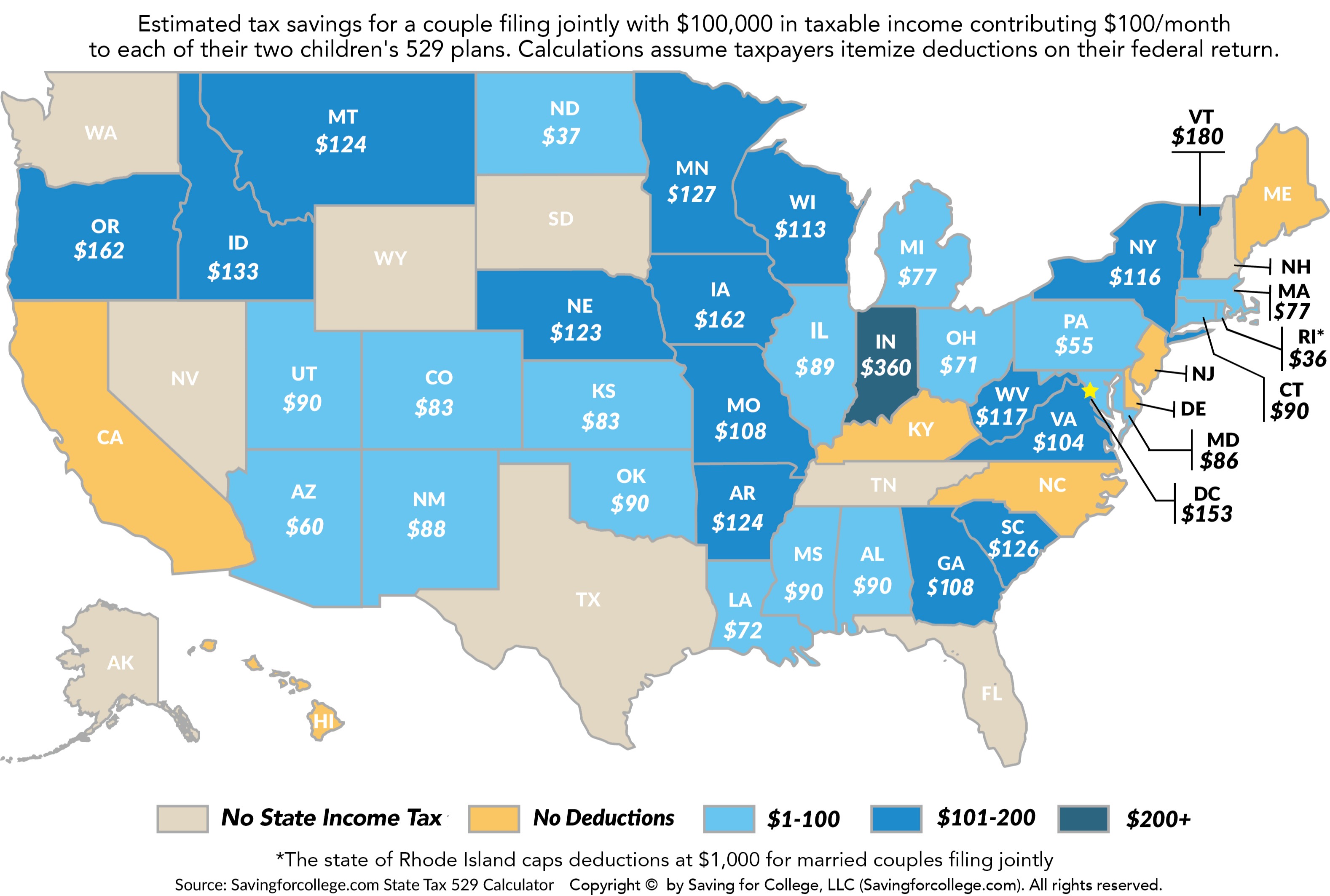

Does Your State Offer A 529 Plan Contribution Tax Deduction

Social Security Checks Are Being Reduced For Unpaid Student Debt Student Loan Payment Student Debt Federal Student Loans

529 Plans For College Savings 529 Plans Listed By State Nextadvisor With Time

Njbest 529 College Savings Plan New Jersey 529 College Savings Plan Ratings Tax Benefits Fees And Performance

529 Plans Which States Reward College Savers Adviser Investments

Nj College Affordability Act What You Need To Know Access Wealth

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

How Do I Choose A 529 Morningstar 529 College Savings Plan Saving For College How To Plan

How Much Is Your State S 529 Plan Tax Deduction Really Worth

Usa 529 Plan Tax Savings 2019 How To Plan Tax Credits Tax Deductions